EDG Guide

Complete comprehensive guide in the form of Q&A’s that includes all current use-cases of EDG and how they play a role in the Edgeware network.

Complete comprehensive guide in the form of Q&A’s that includes all current use-cases of EDG and how they play a role in the Edgeware network.

What are coins / tokens?

EDG is a token. The term coin generally refers to any cryptocurrency that has its own separate, standalone blockchain. The term token or digital tokens can refer to any cryptocurrency that is built on top of an existing blockchain. In Edgeware’s case the argument could be made either way but the community refers to the units of blockchain value on Edgeware as ‘EDG tokens’. Specifically native tokens that are not to be confused with dapp or ‘decentralized application’ tokens. Cryptographic tokens, or ‘tokens’ for short, are programmable digital units of value that are recorded on a distributed ledger protocol such as a blockchain. Tokens do not have their own blockchain but depend or exist on an existing blockchain. Tokens may represent fungible or in-fungible units of value in the form of money, coins, points, digital items, or representations of real-world physical items and rights.

Tokens can only be accessed with the private key for the address holding the tokens and can only be authorized via this private key. Therefore, it is widely held that whoever has possession of the private key that can be used to access the tokens is the owner of those tokens. This direct custody becomes useful in cases where tokens are used to represent ownership of physical items that sometimes are subject to fraudulent activity, such as land and mineral rights.

More information on coins and tokens here.

Where do tokens come from, why, how?

An initial coin offering (ICO) is the cryptocurrency industry’s equivalent to an initial public offering (IPO). A company looking to raise money to create a new coin, app, or service launches an ICO as a way to raise funds. Interested investors can buy into the offering and receive a new cryptocurrency token issued by the company. This token may have some utility in using the product or service the company is offering, or it may just represent a stake in the company or project.

The genesis of the Edgeware network minted 5 Billion EDG tokens.

Of this 5 Billion, 90%, or 4.5 billion were distributed through what is called the ‘Lockdrop’ process. The 10% remainder was was distributed as such:

4.5% to Commonwealth Labs, the developers of Edgeware, and will not be used to fund development. 3% to Parity Tech for support services on their Substrate product. 2.5% reserved for Community Incentives, OSS development, or other network success goals.

A Lockdrop is an airdrop where token holders of one network lock 5 their tokens in a smart contract for a fixed or variable time period, the ’lock duration.’ The purpose of this novel method of token distribution is to more fairly, securely and widely align incentives among the active participants, select for and incentivize committed initial participants of the network, and leverage existing token distributions in order to create relatively more diverse and wide distributions.

In the case of Edgeware, Ether holders were able to participate through two interaction types: a ’Lock’ where they send and make inaccessible their ETH tokens for an elected duration of 3, 6 or 12 months, or to ’Signal’ their intent to participate in the Edgeware network. ’Signaling,’ is similar to an airdrop in that no lock duration is imposed and the participant’s tokens remain accessible however Signal participants received a reduced allocation compared to a Lock interaction.

For those that choose to Lock their tokens, longer lock duration corresponds to proportionally more Edgeware tokens received, and these were distributed at the launch of the network. The Lockdrop process is a more fair and secure way to distribute tokens in a Proof-of-Stake network for the following reasons:

A non-zero opportunity cost

To participate in the Lockdrop, individuals had to forgo the opportunity cost of ETH for the duration of the Lockdrop–e.g. being able to lend on Compound. For long-term ETH holders, this opportunity cost is irrelevant. For this reason, long-term ETH holders are most aligned with the EDG Lockdrop. The minting of EDG tokens will allow token holders to participate in all the rights allocated to Edgeware participants–becoming a validator or voting on network proposals.

Downside Protection

At the end of the Lockdrop, participants will have access to two productive utility tokens, ETH and EDG respectively. As Edgeware is a new and experimental chain, in the event of a malicious attack or exploit on the Edgeware network, Lockdrop participants will still retain their ETH, eliminating the long-term risk of participation.

Easy, open and accessible process

A single transaction that sends ETH to the Edgeware Master Lockdrop Contract allows one to receive EDG tokens. Any account can perform this from a hardware or software wallet (e.g., Trezor, Metamask, and more). Moreover, any ETH holder can participate.

Economic Security

Bootstrapping security on a new Proof-of-Stake chain. Ethereum is bootstrapping the Serenity release from an initial crowd-sale and Proof-of-Work block reward. In the same way, Edgeware can use the already-wide distribution of Ethereum holders to bootstrap the economic security of the Edgeware chain.

Contract Security

When calling lock from the Master Lockdrop Contract, an individual Lockdrop User Contract is created, which actually holds the time-locked ETH of a participant. This significantly improves fund security, because value is not stored.

More information on the Edgeware Lockdrop here.

How are EDG tokens regulated and controlled?

EDG tokens are meant to move throughout the ecosystem in a very organic and orderly matter. This can be achieved through both governance, and the treasury.

What is on-Chain governance?

On-chain governance is a system for managing and implementing changes to cryptocurrency blockchains. In this type of governance, rules for instituting changes are encoded into the blockchain protocol.

On-Chain governance allows the community that controls the majority of EDG to make major decisions about how the EDG token should be controlled within the context of the Edgeware network. Edgeware stakeholders will be able to collaborate on the roadmap of the network through on-chain signaling, by holding informal votes for the inclusion of specific items and proposals. This planning stage is a natural precursor to the on-chain governance process, and formal votes are held to fund and upon which agreed upon features are implemented. Establishing robust procedures for conducting on-chain upgrades is an essential step towards ensuring the security of the network. All network upgrades should be audited and tested by multiple independent parties, and additionally approved by a significant quorum of EDG holders.

More information on Edgeware governance here.

The following are parameters with links to sections of governance which require EDG within the on-chain model:

Referenda: Minimum EDG Deposit to Vote 100 EDG. — Guides to Referenda

Candidacy Bond: A user must bond 1000 EDG to submit their candidacy. — Run for Council

Proposal Bond: The amount required to bond in order to propose a treasury spend is 5% and minimum 1000 EDG. If approved, it is returned, if the proposal fails, it is burnt. — Proposing a Treasury Spend

Signaling Proposal Bond: The amount of EDG required to bond to submit a signaling proposal is 100 EDG. — Signaling

Required Bond Per Identity: A bond of 10 EDG is required to store IDs on-chain — Identity

Additional Identify field: A bond of 2.5 EDG is required to store additional IDs on-chain beyond legal name. — Identity

Sub-Account Deposit: A bond of 2 EDG is required in order to create a sub account (Max sub accounts 100). — Identity

Treasury

Edgeware uses a treasury mechanism to achieve self-sustainability and permit creative incentivization of all stakeholders in the ecosystem, including core and dapp development, ecosystem support and much more.

These funds can be deployed through a Treasury Spend action which is subject to council approval but can be proposed by any EDG holder.

EDG Accrual to the Treasury

The treasury obtains funds in several ways that mimic governments — minting, fees and taxes.

- Minting: A portion of the EDG produced with each block goes to the treasury.

- Slashing: When a validator is slashed for any reason, the slashed amount is sent to the Treasury. Slashed EDG may also accrue to the treasury through failed governance proposals.

- Transaction fees: A portion of each block’s transaction fees goes to the Treasury, with the remainder going to the block author.

- Staking inefficiency: Inflation is designed to be ~20% in the first year, and the ideal staking ratio is set at 80%, meaning 80% of all tokens should be locked in staking. Any deviation from this ratio will cause a proportional amount of the inflation to go to the Treasury. In other words, if 80% of all tokens are staked, then 100% of the inflation goes to the validators as reward. If the staking rate is greater than or less than 80%, then the validators will receive less, with the remainder going to the Treasury.

- Lost Deposits: These may be abandoned bonds from voting, proposals or otherwise.

More information on the treasury here.

What determines the price of EDG?

Like any other digital asset, the price of any individual item is usually in correlation to supply and demand of that item. When the supply is higher, the value is lower, and vice versa. Furthermore, value is obtained from an asset that may have utility. In Edgeware, like previously mentioned, EDG has a lot of functionality within the Edgeware Network so the price associated with the EDG token can fluctuate a lot in the context of how the chain is upgrading itself as time progresses.

More information on cryptocurrency pricing here.

How does EDG relate to smart contracts?

EDG is used for paying transaction fees in state changes on smart contracts. Due to resources in a blockchain network being limited such as storage and computation, transaction fees prevent individual users from consuming too many resources. Edgeware uses a weight-based fee model as opposed to a gas-metering model. As such, fees are charged prior to transaction execution; once the fee is paid, nodes will execute the transaction.

Fees on the Edgeware are calculated based on three parameters:

- A per-byte fee (also known as the “length fee”)

- A weight fee

- A tip (optional)

The length fee is the product of a constant per-byte fee and the size of the transaction in bytes.

Weights are a fixed number designed to manage the time is takes to validate a block. Each transaction has a base weight that accounts for the overhead of inclusion (e.g. signature verification) as well as a dispatch weight that accounts for the time to execute the transaction. The total weight is multiplied by a per-weight fee to calculate the transaction’s weight fee.

Tips are an optional transaction fee that users can add to give a transaction higher priority.

Together, these three fees constitute the inclusion fee. This fee is deducted from the sender’s account prior to transaction execution. A portion of the fee will go to the block producer and the remainder will go to the Treasury. At Edgeware’s genesis, this is set to 20% and 80%, respectively.

More information on transaction fees here.

Where can I go to obtain EDG?

Edgeware can be purchased through a few exchanges that currently offer EDG. This includes:

Future exchanges will be listed as the network continues to grow and expand which will offer much more liquidity and ease of use when trying to buy and sell EDG.

What is staking and how do I stake EDG?

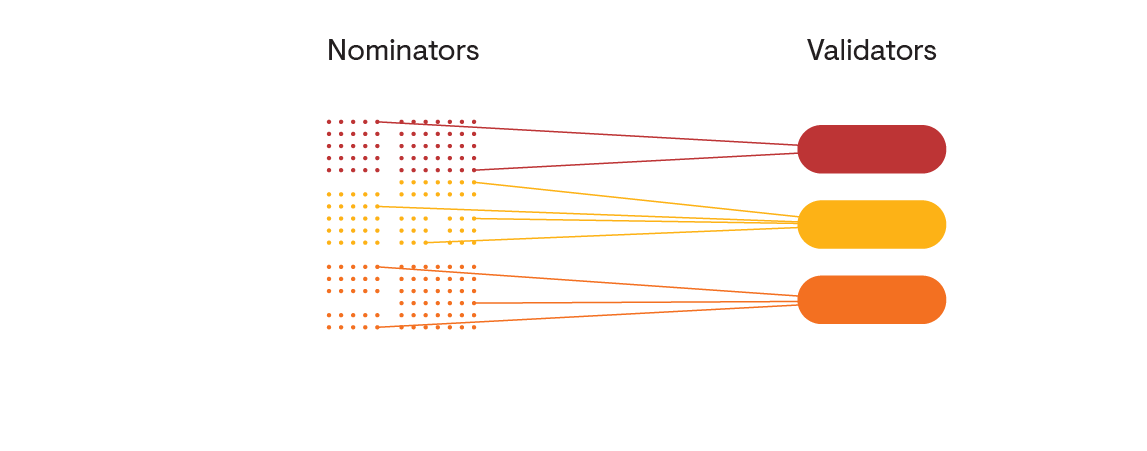

Edgeware uses a version of proof-of-stake called Nominated Proof-of-Stake. Nominated Proof-of-Stake is the process of selecting validators to be allowed to participate in the consensus protocol. NPoS is a variation of Proof-of-Stake and used in Substrate-based Blockchains. The main two actors involved in NPoS are Validators and Nominators.

- Validators provide the infrastructure and maintenance for the network. They are responsible for the production of new blocks, the validation of parachain blocks, guaranteeing finality and ultimately the security of the network.

- Nominators are EDG holders who contribute to the security of the network by economically backing (aka “nominating”) up to 16 validators of their choice with their tokens (aka “stake”). Nominators share part of the rewards earned by the validators in the active set that they nominated.

The following link is a great comprehensive guide for nominators that are looking to delegate/nominate their EDG presented by Stakefish.

For more information on staking, refer to the Edgeware documentation

For setting up a validator, refer to the Edgeware documentation

For more information on Polkadot and Edgeware:

Polkadot’s Website / Edgeware’s Website / Substrate

Join the discussion!

Polkadot’s Twitter / Edgeware’s Twitter / Edgeware’s Telegram / Polkadot’s Telegram / Polkadot’s Github