2021—Peak of the 4th Crypto Cycle

We’re headed towards the peak of the fourth crypto cycle. As of March 2021, more than $20 billion worth of various cryptocurrencies is locked in decentralized finance (DeFi)...

We’re headed towards the peak of the fourth crypto cycle. As of March 2021, more than $20 billion worth of various cryptocurrencies is locked in decentralized finance (DeFi), popular companies like Tesla and Square started to hold Bitcoin on their balance sheets, and Non-Fungible Tokens (NFTs) are mainstream.

About every four years, there’s a buzz around cryptocurrencies. It typically starts with the price of major currencies like Bitcoin and Ethereum increasing.

As the price goes up, so does interest. Cryptocurrencies start trending on social media and mainstream press alike as prices hit “all time highs.”

What is missed amidst all the hype is the number of people who join the movement with new ideas. Eventually, a subset of those ideas turns into startups and projects that fuel the following cycle.

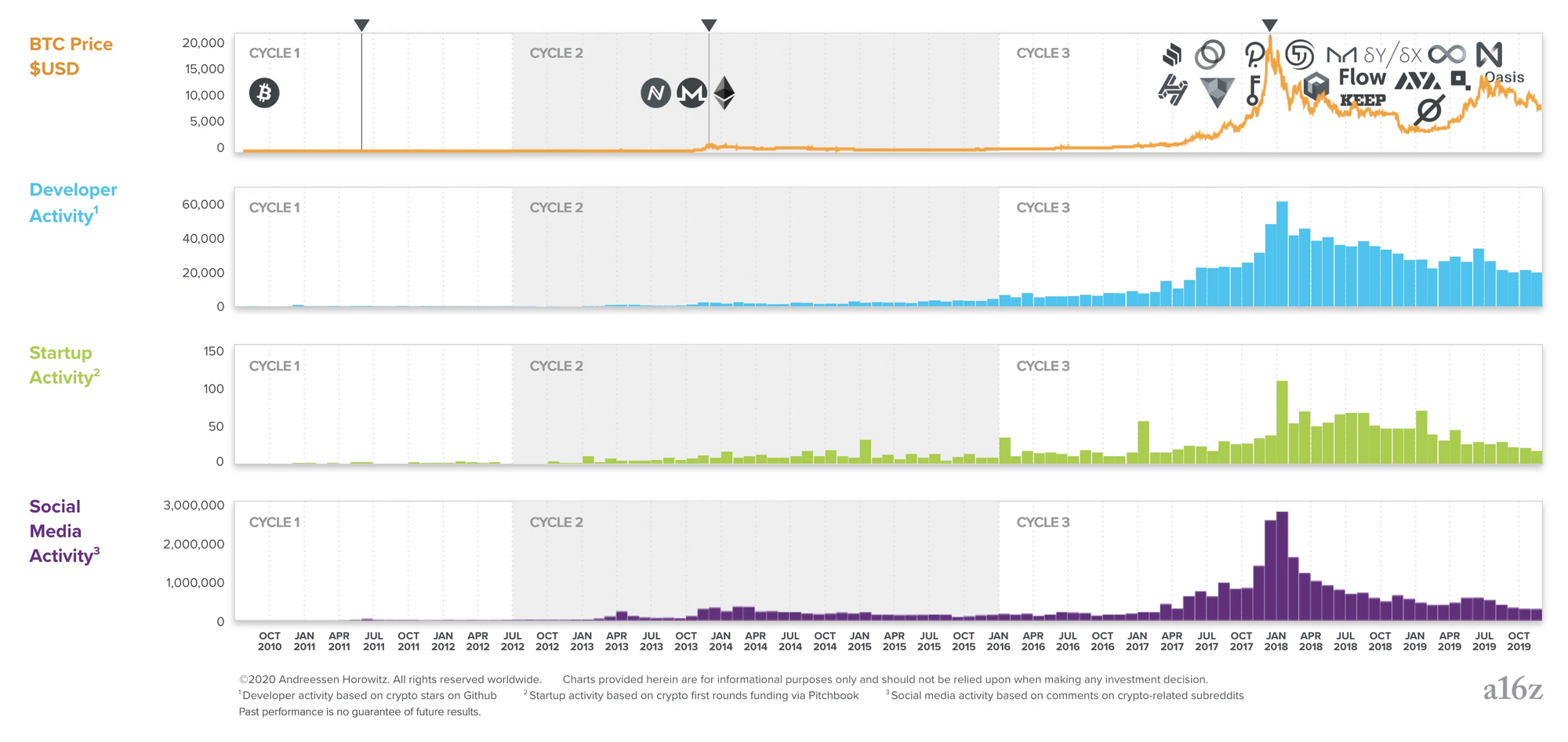

Chris Dixon and Eddy Lazzarin at a16z observed this trend both anecdotally and with data when they coined “The Crypto Price-Innovation Cycle.”

Crypto Cycle Peaks

Cycle 1: 2009-2012

- 2011: After the Bitcoin white paper released in 2009, many of today’s largest exchanges, miners, and wallets were founded in 2011. Some exchanges started around that time include Mt. Gox, BitInstant, Bitcoin Market, and Coinbase.

Cycle 2: 2012-2016

- Late 2013: Ethereum is founded while the number of developers and startups increases tenfold. Other popular coins at the time include Litecoin, Namecoin, Peercoin, and Novacoin.

Cycle 3: 2016-2019

- 2017: Crypto gains mainstream attention, becomes a startup sector, and a new asset class for institutional investors. Morgan Stanley Research estimates over 84 new funds formed that managed about $2 billion in capital. Edgeware and Commonwealth were started around the same time.

Cycle 4: 2019-Present

- 2021: More than $20 billion worth of various cryptocurrencies is locked in decentralized finance (DeFi use cases like lending, decentralized exchanges, payments, and derivatives) based on data from analytics site DeFi Pulse.

Popular companies like Tesla and Square start to hold Bitcoin on their balance sheet. Attention moves away from strict financial/infrastructure applications to ownership of digital assets via Non-Fungible Tokens (NFTs).

Projects in each cycle can be broken into 4 layers

Many of the projects in the first two cycles, like Bitcoin, Ethereum, and Dfinity focused on tackling problems in layers 1, 1.5, and 2. While in cycles three and four, we see a lot more progress on layer three solutions.

Layers 0 to 3 Unpacked

Layer 0

Polkadot connects blockchains and enables cross-blockchain transfers of any data and asset, not just tokens. It lies below Ethereum and Bitcoin’s blockchains and makes them interoperable by communicating with one another.

Layer 1

Blockchains are a solution to the Byzantine Generals’ Problem through consensus. It’s a way of achieving consensus and coming to an agreement about a state of affairs through decentralized systems and distributed power.

Layer 2

Ethereum enabled smart contracts allowed for the addition of logic to the chain. With logic, developers can build decentralized applications on top of blockchains.

Edgeware is a smart contract chain with a community-managed treasury, decentralized proposal system, and network of DAOs.

Layer 3

Decentralized programs are run outside the blockchain but connect to it. For example, dydx exchange is an open platform for advanced crypto financial products powered by the Ethereum blockchain.

Some benefits of decentralized applications include:

- No need to trust a central authority

- No single point of failure

- Less censorship

- Potential for network ownership alignment

Holding Bitcoin on the Company’s Balance Sheet

According to the data on March 1, 2021, compiled by @NVK on BitcoinTreasuries, companies own $65 billion in aggregated value. They’re holding 1,350,073 BTC or 6.43% out of the 21 million maximum supply. Some notable companies include Tesla and Square.

Non-Fungible Tokens (NFTs) go Mainstream

Non-fungible refers to something that is unique and cannot be replaced by something else. For example, a dollar is fungible. Trade one for another and you’ll have the same buying power.

Something that’s non-fungible cannot be replaced. An example of such an item is one of a kind trading card or an Aston Martin car used in a James Bond movie. Once it’s gone, it cannot be replaced.

In March of 2021, we witnessed a boom in demand for NFTs. Beeple (Mike Winkelmann), a Wisconsin based artist, sold his collection Everydays for $69M on Christies auction house.

Where we’re headed

The fourth crypto cycle is still ramping up. For teams working on blockchain projects, it’s exciting to have a front-row seat as product adoption grows. The first two crypto cycles were highly correlated with bitcoin’s halving. Over the next couple of years, we’ll see faster cycle times as product adoption grows and new founders join the movement by starting projects.